What Are Opportunity Zones?

Opportunity Zones are federally designated census tracts created under the Tax Cuts and Jobs Act of 2017 to drive private investment into underserved communities. Investors who reinvest capital gains into these zones can access significant tax incentives while supporting job creation and economic development.

What Is an Opportunity Fund?

An Opportunity Fund is an investment vehicle used to deploy capital into Qualified Opportunity Zones. These funds support projects such as real estate, infrastructure, and business development, while offering long-term tax advantages to investors.

Why Invest in Opportunity Zones?

Opportunity Funds offer:

- Deferral of capital gains taxes until 2026

- Reduction in tax liability after 5 years

- No taxes on new gains after 10 years

These benefits make Opportunity Zones a powerful tool for impactful and tax-advantaged investment.

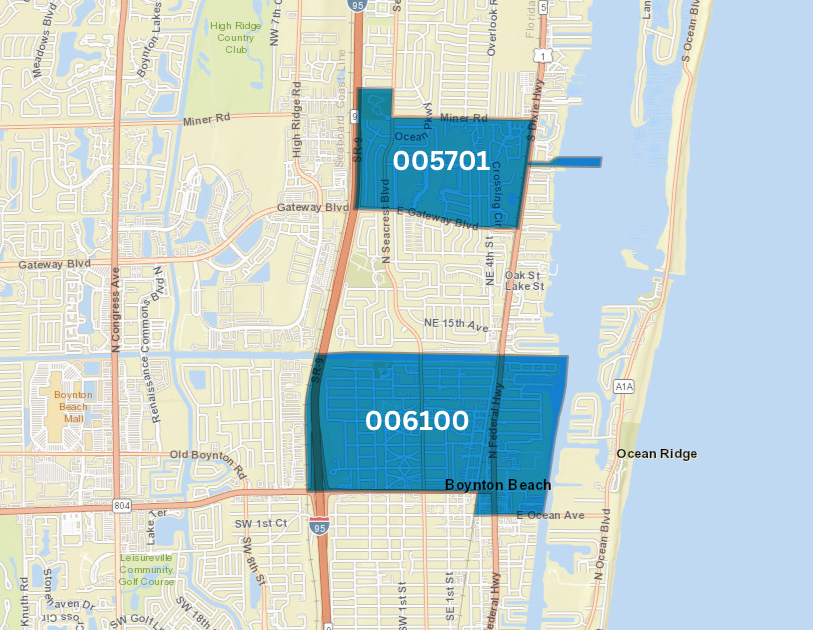

Boynton Beach’s Opportunity Zones

Boynton Beach features two federally designated zones:

- Gateway Blvd & Federal Hwy (Census Tract 005701)

- I-95 & Boynton Beach Blvd (Census Tract 006100)

The City actively promotes development in these areas by connecting investors with projects, supporting redevelopment, and fostering inclusive economic growth.

News and Resources